Retention in Construction: Formulas, Bonds & Accounting Guide

What Is Retention in Construction?

Retention in construction contracts is a contractual financial mechanism where a portion of a contractor's payment is withheld by the employer. It ensures that the contractor fulfills their obligations—including defect correction and final project delivery. This guide explores construction retention types, formulas, and accounting practices, and includes real-world examples.Types of Construction Retention and Their Formulas

1. Fixed Retention Percentage

A consistent percentage is withheld from each interim payment.

Retention Amount = Interim Payment × Retention Percentage Example: If the contractor is owed $100,000 and the retention rate is 10%, the withheld amount is $10,000.

2. Capped Retention

Retention deductions stop once a predefined cap is reached.Formula:

Retention Amount = min(Interim Payment × Retention %, Retention Cap) Example: For a cap of $50,000 and 10% retention, deductions stop once $50,000 is withheld.

3. Dual Release Retention

Retention is released in two phases: practical completion and after the Defect Liability Period (DLP).Formula:

Retention at Practical Completion = Total Retention × 0.5 Retention After DLP = Total Retention − Retention at Practical Completion Example: For $20,000 retention: $10,000 at completion, $10,000 post-DLP.

4. Sliding Scale Retention

The retention percentage decreases as the project progresses.Formula:

Retention Amount = Interim Payment × Applicable Retention % (based on project stage) Example: 10% for first 50% of the project, 5% for the next 30%, and 0% for the remaining 20%.

5. Retention Bond

A financial instrument replaces cash retention.Formula:

Retention Bond Value = Retention Cap or Total Retention Example: For a $50,000 cap, a bond is issued instead of withholding cash.

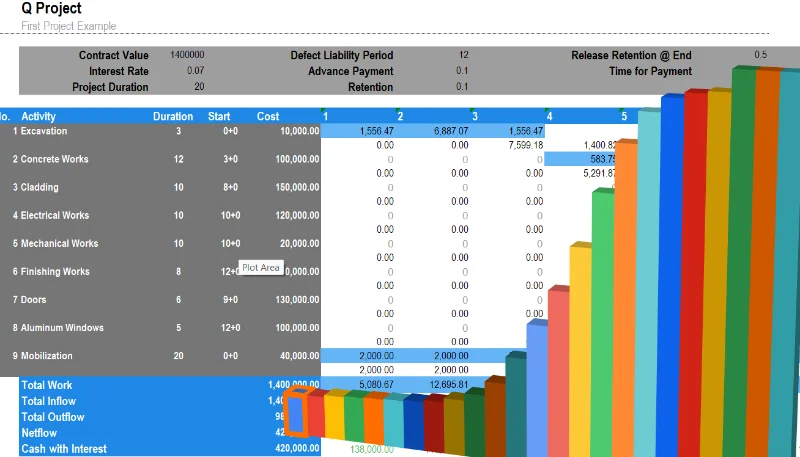

Effects of Retention on Contractor Cash Flow

1. Cash Flow Constraints

Reduces immediate funds, affecting payments to suppliers and workers.

2. Working Capital Pressure

Retention often forces contractors to secure financing or inject extra working capital.

3. Motivation for Quality

Contractors stay engaged until DLP ends, ensuring defects are corrected.

4. Potential Tension

Delayed or excessive retention can damage contractor-employer relationships.

Why Construction Retention Is Used

-

Quality Assurance: Ensures post-completion fixes are handled.

-

Risk Mitigation: Protects the employer if the contractor defaults.

-

Performance Accountability: Encourages full, proper completion.

Real-World Use Cases

Residential Projects

Retention ensures fixes after handover, e.g., plumbing or wiring issues.

Infrastructure Projects

Capped retention secures employer interest without severely impacting large contractors.

Commercial Developments

Sliding scale retention aligns with performance milestones.

High-Risk Projects

Retention bonds replace withheld cash in complex jobs like airports.

Public Sector Contracts

Often follow dual-release structures with fixed retention percentages.

Accounting for Retention in Construction

For Employers

Initial Withholding:

Debit: Construction Expense Credit: Retention Payable Release of Retention:

Debit: Retention Payable Credit: Bank/Cash For Contractors

Retention Receivable:

Debit: Retention Receivable Credit: Revenue On Receiving Payment:

Debit: Bank/Cash Credit: Retention Receivable Periodic Review

Both parties should reconcile retention balances regularly.

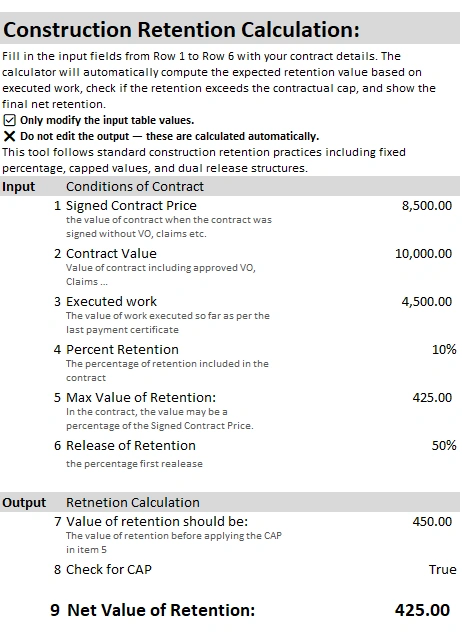

Download the Free Construction Retention Calculator (Excel)

Enter your project details (executed work, retention %, cap value, etc.), and the calculator will handle all the math.

✅ Supports fixed % and capped retention

✅ Calculates retention release and final net retention

✅ Easy input layout with highlighted sections

References

-

Gould, N., & Joyce, R. (2017). Construction Law: Retention and Payment Security.

-

RICS (2020). Retention in Construction Contracts: Current Practices and Impacts.

-

CIOB (2021). Retention Policies in the Construction Industry.

-

FIDIC (2017). Conditions of Contract for Construction.

-

Quollnet.com (2024).Defect Liability Period.