How to Create a Project Cash Flow for Contractors

Managing cash flow is critical for contractors working on construction projects. An accurate project cash flow plan allows you to keep track of costs, plan for payments, and ensure that the project remains financially viable. This guide will help you understand how to create a project cash flow, incorporating key components like contract conditions, activity planning, indirect costs, and financial adjustments such as retention, work in excess of billing (WIEB), and advance payments.

1. Understanding Main Contract Conditions

The main contract contains several terms that directly affect cash flow. As a contractor, you must be aware of these conditions, as they will guide the timing and structure of your project’s inflows and outflows:

- Time for Payment : The period between submitting a bill and receiving payment from the client (e.g., 30 or 60 days).

-

Retention

: A percentage of each payment withheld by the client until certain milestones are met. This is usually released in two stages:

- At Handover : A portion of the retention is released when the activity is completed.

- At the End of Defect Liability Period (DLP) : The remainder is released after the DLP is complete, during which any defects must be corrected.

- Advance Payment : Some contracts include an advance payment to the contractor at the start of the project. This advance is typically deducted from subsequent payments on a prorated basis.

2. Identify Financial Constants

Before starting cash flow calculations, you must define certain financial parameters:

- Interest Rate or Desired Rate of Return (ROR) : This is the interest rate you will use when calculating the cumulative cash flow.

3. Planning Project Activities

Each project must be broken down into individual activities. For each activity, consider the following factors:

- Start Date and Duration : When the activity will begin and how long it will last.

- Work Period and No-Work Periods : Some activities may involve mobilization or manufacturing, where no site work is performed but costs are incurred.

- Cost of Each Activity : Determine the total cost for each activity (e.g., excavation, foundation work, etc.).

- Percent Subcontracted : Determine how much of the work is subcontracted. Subcontracted work is often subject to retention, WIEB, and advance payment adjustments.

- Work in Excess of Billing (WIEB) : WIEB refers to work that has been completed but not billed yet. This will affect cash flows in subsequent billing cycles.

4. Managing Indirect Costs

Indirect costs refer to overhead costs that are not directly tied to specific activities but are necessary for the project's execution. These include:

- Human Resources : Salaries for administrative personnel, site supervisors, etc.

- Equipment : Costs for equipment rental, operation, and maintenance.

- Temporary Mobilization : Setting up temporary infrastructure such as site offices.

To account for indirect costs in cash flow, you can create "fake activities" that spread the costs over their duration. For example, temporary site offices may incur costs throughout the entire project, while equipment may only be needed for certain phases.

Step-by-Step Cash Flow Process

A. Creating a Work Cash Flow for Each Activity

You can use mathematical formulas to better predict each activity work flow distribution: in this

For each activity, calculate the cash flow using the following steps:

- Start Date and Duration : Determine when the activity begins and how long it will last.

-

Cost Spread

: Divide the total cost of the activity by its duration to get the period cost. nb: this is an estimation that the cost is spread equally. This is not true in most cases. For this reason application such as CASHFLOWPOT.com can assist you in doing a more accurate curved spread.

Monthly Activity Cost = Total Activity Cost / Duration (Months) - Subcontracted Work : For subcontracted work, account for WIEB, retention, and advance payments in cash flow calculations.

-

WIEB Adjustment

: Work in excess of billing for subcontracted activities needs to be moved to the next period's cash flow:

Work Cash Flow = (1 - WIEB) * Work of Previous Period + Work of Current Period * WIEB

B. Calculating the Outflow for Each Activity

Outflows include the cost of the activity, retention, and advance payment deductions. The formula for outflow is as follows:

Outflow = Activity Cost - Retention (for this period) - Advance Payment (if applicable)Work in excess of billing (WIEB) should not be included in the outflow for the current period but carried over to the next billing period.

C. Total Work Cash Flow and Total Outflow

To get the total work cash flow and outflow for a given period, sum the cash flows and outflows from all activities:

Total Work Cash Flow = ∑ (Monthly Cash Flow for each activity)Total Outflow = ∑ (Monthly Outflow for each activity)D. Generating the Project Inflow

Inflow represents the amount billed to the client, adjusted for WIEB, retention, and advance payment recovery:

Inflow = (1 - WIEB) * Work of Previous Period * % Subcontracted + Work of Current Period * WIEB * % Subcontracted + Work of Current Period * (1 - % Subcontracted)After calculating inflow, deduct the retention and any recovery of advance payments.

E. Net Cash Flow and Cumulative Cash Flow

Calculate the net cash flow by subtracting outflows from inflows:

Net Cash Flow = Inflow - Total OutflowTo calculate cumulative cash flow, account for the interest rate or desired return on investment:

Cumulative Cash Flow = ∑ (Net Cash Flow * (1 + Interest Rate))Application that will do all this for you

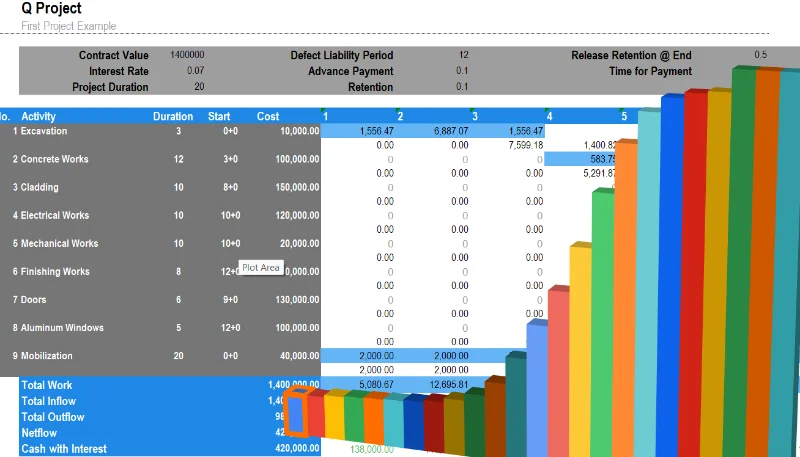

Example of Cash Flow Calculation

Let's consider a project with the following conditions:

- Foundation work starts in Month 1 and lasts 3 months, with a total cost of $200,000.

- 80% of the foundation work is subcontracted, while 20% is done by the contractor directly. The subcontracted portion is subject to retention, WIEB, and advance payment.

- Work in Excess of Billing (WIEB) is 10%, meaning 10% of the subcontracted work in Month 1 will be moved to Month 2 for billing.

- Retention is 5%, with 50% released at the handover and 50% at the end of the Defect Liability Period (DLP).

- An advance payment of $50,000 was given to the subcontractor, to be deducted on a prorated basis.

Month 1 Breakdown

1. Work Done in Month 1:

Total monthly cost: $66,667 ($200,000 / 3 months).

Subcontracted Portion (80%) :

66,667 * 0.8 = 53,334

Contractor Portion (20%) :

66,667 * 0.2 = 13,333

2. Work in Excess of Billing (WIEB):

10% of the subcontracted work will be billed in Month 2.

WIEB = 53,334 * 0.1 = 5,333

Billed Amount for Subcontracted Work in Month 1 :

53,334 - 5,333 = 48,001

3. Retention:

Retention for the subcontracted portion is 5%.

Retention = 48,001 * 0.05 = 2,400

4. Advance Payment Deduction:

The advance payment of $50,000 is spread evenly over 5 payments:

Advance Payment Deduction = 50,000 / 5 = 10,000

5. Outflow Calculation:

Subcontracted Outflow for Month 1 :

Outflow = 48,001 - 2,400 (Retention) - 10,000 (Advance Payment) = 35,601

Contractor's Outflow (not affected by WIEB or retention):

Outflow = 13,333

6. Total Outflow for Month 1:

Total Outflow :

Total Outflow = 35,601 (Subcontracted) + 13,333 (Contractor's Portion) = 48,934

The total outflow for Month 1 is $48,934.